As we head into 2026, more employers and health plans are working to achieve a balanced approach for their members. The focus is being put on how we can balance the costs with the benefit, which is increasingly difficult as nearly one in five dollars spent in the U.S. economy goes toward healthcare.

Achieving balance requires payers to evaluate not only medical and pharmacy expenses, but also to further assess the interplay between physical and mental health, as well as financial considerations influencing member behavior.

Physical, mental, and financial health considerations

Physical health encompasses management of chronic conditions, such as diabetes and asthma, addressing weight-related issues, and even obtaining preventive healthcare services. All of this helps to keep members healthy and avoid costly ER visits or admissions.

Common mental health issues, such as anxiety, depression, and substance abuse, have led to the 15%+ rise in MHSA PMPM that we have seen in our semi-annual norms. Additionally, members’ mental health may be impacted as they deal with family members who have chronic conditions such as cancer, or if they face the challenge of being a caregiver for adult children or aging parents.

The third piece of the puzzle is financial. Payers focus on helping their members and families achieve financial security, often providing options like 401(k) plans or Health Savings Accounts (HSAs). By storing this information in data warehouses, payers can track member contributions to these programs and identify the plans members choose to join.

Payers invest heavily in programs and vendors to support their members. As healthcare costs continue to rise annually, these initiatives are expected to increase.

Plan design versus neighborhood minority

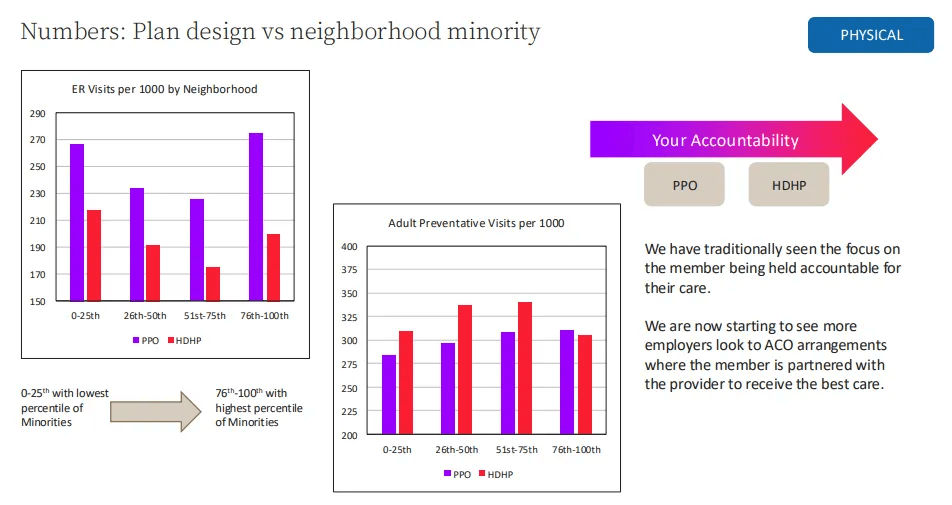

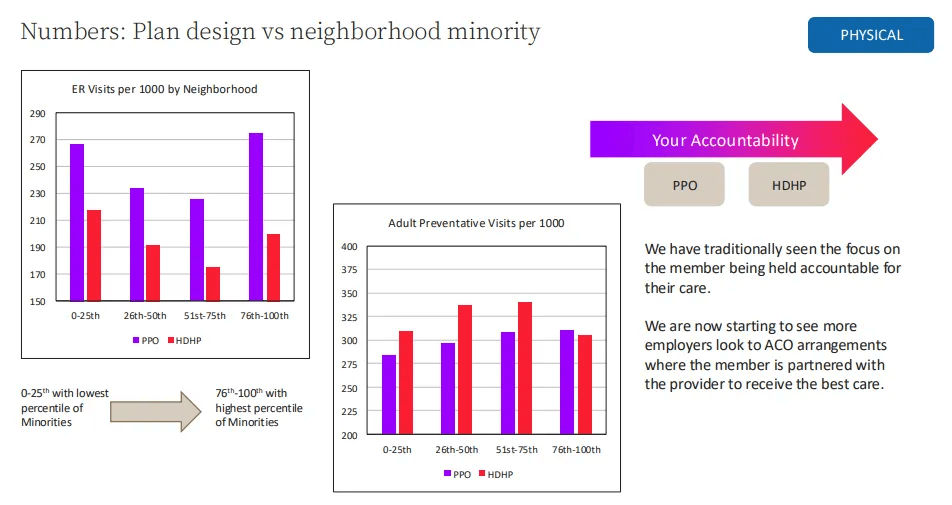

Payers continually assess plan design to ensure it meets members' needs. Let’s look at preferred provider organizations (PPOs) and high-deductible health plans (HDPHs). While both PPOs and HDHPs hold members accountable for usage, they produce different outcomes.

Market data factoring in the CDC’s Social Vulnerability Index based on the neighborhood minority percentile shows PPO members visit the ER more often across all neighborhoods than those with HDHPs. This directly impacts the shared costs for payers. Because PPOs do not require coordination by a primary care physician, this may result in reduced preventive care, limited chronic disease management, and an increased risk of conditions escalating into emergencies.

Conversely HDHP members typically have higher rates of adult preventative visits per 1,000 compared to their PPO counterparts, regardless of demographics. This is likely because under federal rules, HDHPs must cover preventive services at no cost to the member — no deductible, no copay. This includes screenings, vaccines, and many early‑detection services. Because everything else in an HDHP is expensive until the deductible is met, members are strongly incentivized to take advantage of the free services they do get. Yet we see in the highest areas of minority, members are not taking advantage of these services.

Recently, more payers are exploring alternatives beyond traditional PPOs and HDHPs for employees and their families.

Evaluating best plan type

If we shift accountability from just PPO and high-deductible health plans to include providers—such as those in an accountable care organization (ACO), patient-centered medical home (PCMH), narrow network, or bundled payments—we can better share responsibility and manage costs. As a trend we are seeing more payers, and even specifically more employers, are exploring ACOs and value-based care models to guide members into these plans.

These models shift care away from volume and towards value, and the evidence behind them is getting harder to ignore. For payers, fewer avoidable ER visits and better chronic disease control translate directly into lower medical loss ratios.

These programs reward:

- Quality over quantity

- Preventive care and early intervention

- Cost‑efficient care pathways

This aligns with payer strategies to control long‑term cost trends while improving member experience.

The risk of rising healthcare costs

One impactful method we recommend involves assessing the risk of rising healthcare costs. The Risk of Rising Cost model represents a prospective risk score that evaluates several factors.

Machine learning and artificial intelligence models play a critical role in this process. It is well-documented that a significant proportion of healthcare expenditures are attributed to a relatively small segment of the population. Recent MarketScan data demonstrates that, among individuals categorized as high-cost in any given year, approximately half do not remain in the highest-cost group in the following year. Therefore, accurately identifying and monitoring individuals at high risk—and implementing targeted interventions to manage costs—is essential for payers.

More than 400 variables drawn from medical, pharmacy, and eligibility data contribute to the model, including age, gender, disease categories, specific procedures, specialty medications, time-sensitive utilization metrics, and recent inpatient costs (e.g., average IP cost in the last three or six months).

Collectively, these features enable the model to predict the likelihood of rising costs, the probability of inpatient admission, primary risk drivers, and anticipated second-year expenditures at the individual patient level.

By utilizing models like the Risk of Rising Cost, organizations can more effectively target their value-based programs to positively influence members who are at risk for high costs.

Site of care optimization

An additional approach to addressing the substantial physical costs associated with member care is the implementation of site-of-care analytics. This capability remains one of the most significant yet underutilized tools in contemporary healthcare strategy. It sits at the intersection of cost, quality, and access, helping organizations understand where care is delivered, why, and how those choices affect outcomes and spending.

It’s the discipline of analyzing data to determine the most effective and efficient setting for delivering care. Organizations use this analysis to reduce unnecessary high‑cost utilization, improve patient experience, and optimize resource allocation. When applied specifically to site‑of‑care decisions, it enables:

- Cost optimization: Identify procedures that can safely shift from inpatient to outpatient or ASC settings.

- Quality improvement: Compare complication rates, readmissions, and outcomes across sites.

- Patient access expansion: Understand geographic gaps that might exist.

- Value‑based care performance: Align care settings with bundled payments, ACO goals, and risk‑based contracts.

Some such use cases are:

- Shifting elective surgeries to Ambulatory Surgery Centers

- Optimizing infusion therapy sites

- Managing high‑cost imaging utilization

Our primary objective is not to eliminate services, but rather to ensure that care is provided in the most cost-effective setting.

Mental health

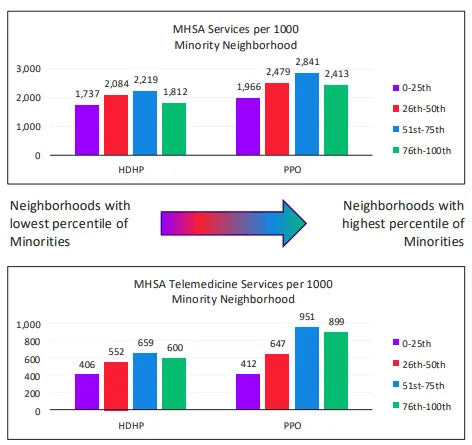

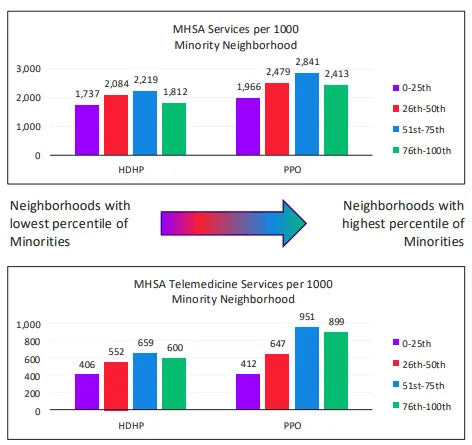

Since 2020, mental health has emerged as a significant priority among Payers. We examined PPO and HDHP across neighborhoods by percentile of minority populations. Neighborhoods with a lower percentage of minorities are marked in purple, while those with higher percentages appear in green. Notably, rates for mental health services increase up to the middle percentiles (26th–75th), then decline sharply in areas with the highest minority concentrations. This tells us that those that live in neighborhoods with the highest minorities are not receiving mental health services. This shows a lack of claims, not a lack of mental health need in a population.

According to the National Alliance on Mental Illness, 23.4% of U.S. adults experienced mental health conditions—a figure that continues to grow annually. This means that more than one in five adults are affected. Additionally, over 120 million Americans reside in federally designated mental health professional shortage areas. Telemedicine usage patterns reveal that individuals enrolled in HDHPs utilize these services far less than those with PPO coverage, regardless of neighborhood demographics.

Mental health has a notable impact on physical health—12.3% of emergency department visits made by U.S. adults annually are related to mental health conditions. Overall, serious mental illness accounts for $193.2 billion in lost earnings annually across the United States. Employers should prioritize addressing mental health in their workforce now, as its impact will only intensify in the years ahead.

Program participation

Many payers are now partnering with various programs aimed at improving mental health. As you engage with these different initiatives, consider the types of data you can collect—this information can help you better understand your population. By combining this data with claims data, you gain a fuller picture of overall wellbeing. Program participation data is particularly valuable, whether it’s from wellness programs, care management, or incentive programs. Understanding how people use your services helps inform your strategy and reveals where members are most engaged. This also allows you to evaluate ROI and make smarter decisions about future investments.

Program participation data consists of participation records by member by program, which can include identification method, participation start and end dates, and program activities.

Payers want to help their population:

- Remain healthy and productive

- Make lifestyle changes

- Manage chronic conditions effectively

As payers implement health programs to aid these efforts, they need to monitor the effectiveness and value of those programs to inform future strategy and ensure they’re targeting the right members.

Point solutions in healthcare

Evaluating point solutions in healthcare has become a mission‑critical skill for payers. The market is overflowing with vendors: there are 300+ solutions across 20+ categories, and most benefits teams are small. Without a disciplined evaluation framework, it’s almost impossible to separate meaningful impact from polished marketing campaigns.

To better understand whether your point solution is having an impact (either a Return on Investment or a Value on Investment), a point solution evaluation will measure the following three components of your program

- Engagement: Are the right people engaging? Are engagement strategies working? Are there barriers to enrollment?

- Behavior change: Is your solution addressing those areas it was intended to address (e.g., improved medication adherence, targeting mental health care)?

- Outcomes: Is there meaningful change in downstream outcomes among those who are participating in the intervention (e.g., lower costs, less unexcused call ins, reduced BMI)?

It is estimated that between $30-$50B is spent on healthcare point solutions every year. Payers need to hold their solutions responsible for engaging the population and producing outcomes. By evaluating the point solutions you are using, you can better understand if they are delivering on their promise.

Financial data

Payers often collect extensive financial data but don’t always integrate it with medical information. Key data includes provider payments, salary, 401(k) and HSA contributions, program premiums, and other relevant metrics. Combining these sources in a data warehouse can offer a comprehensive view of each member.

True financial analytics in healthcare requires examining factors beyond claims, such as affordability and medical loss ratio. These insights impact financial performance and influence population health, benefit design, and care delivery. Integrating financial data allows for enhanced reporting and measurement.

Payers spend a lot on benefits, but they often don’t know whether those benefits are helping. Looking at financial indicators helps.

Employees who are financially stressed are more likely to experience:

- Lower productivity

- More absenteeism

- Higher turnover

- Greater use of mental‑health benefits

When payers look at HSA and 401(k) contribution patterns, they get a window into whether employees feel financially secure enough to save. Low participation can signal financial strain. It’s data‑driven benefits strategy instead of guesswork.

The key is that employers look at aggregate, anonymized data, not individual employee finances. The goal is to understand trends like:

- Are lower‑income employees unable to afford the deductible?

- Are younger employees not saving for retirement?

- Are certain groups opting out of HSAs because they don’t understand them?

These insights help employers build a healthier, more financially stable workforce.

Opportunity Scores

While we have examined solutions for physical, mental, and financial wellness separately, integrating all three domains establishes a comprehensive approach to overall well-being. Our clients often express the need to derive actionable insights from their extensive data, particularly at the member level. In response, we have created opportunity scores tailored to each client’s unique requirements. These scores are produced for every member, reflecting the data provided by clients and aligning with their specific business goals and priorities.

Conclusion

The pursuit of a balanced approach in 2026 involves clinical, financial, and regulatory variables. Employers and health plans must move beyond reactionary measures to proactive strategies that integrate pharmacy management, mental health support, and financial wellness into a cohesive ecosystem.

By leveraging data to understand the interplay between these factors and adopting structural models like ACOs, organizations can stabilize costs while improving the quality of life for their members.